The Ultimate Guide to Ethereum Cryptocurrency: Understanding, Investing, and Future Outlook

Outline

- Introduction to Ethereum Cryptocurrency

- What is Ethereum?

- The Birth of Ethereum

- How Ethereum Works

- Blockchain Technology and Smart Contracts

- Ethereum vs Bitcoin: Key Differences

- Understanding Ether (ETH)

- What is Ether?

- The Role of Ether in the Ethereum Network

- The Ethereum Blockchain Explained

- How Ethereum Blockchain Operates

- The Importance of Decentralization

- Ethereum Mining vs. Staking

- Proof of Work (PoW) and Proof of Stake (PoS)

- Benefits of Ethereum 2.0

- Smart Contracts: Revolutionizing the Digital World

- What Are Smart Contracts?

- How Smart Contracts Work in Ethereum

- Ethereum’s Role in Decentralized Finance (DeFi)

- Introduction to DeFi

- Ethereum’s Impact on the DeFi Ecosystem

- The Rise of Non-Fungible Tokens (NFTs)

- What Are NFTs?

- NFTs on Ethereum

- Ethereum’s Role in Tokenization

- Tokenization of Assets

- Use Cases of Ethereum Tokens

- Ethereum 2.0: A New Era

- What is Ethereum 2.0?

- Key Improvements and Features

- How to Buy Ethereum

- Choosing a Platform to Buy Ethereum

- Storing Your Ethereum Safely

- Risks of Investing in Ethereum

- Volatility and Market Risks

- Security and Regulatory Concerns

- Ethereum’s Environmental Impact

- Energy Consumption of Ethereum Mining

- Transition to Proof of Stake

- Ethereum’s Future: What’s Next?

- Potential for Scalability and Speed

- Upcoming Ethereum Updates

- Conclusion

- The Importance of Ethereum in the Crypto Landscape

- FAQs

- What makes Ethereum different from Bitcoin?

- How do I invest in Ethereum?

- What is the current price of Ethereum?

- What are Ethereum’s advantages for developers?

- How secure is Ethereum compared to other cryptocurrencies?

The Ultimate Guide to Ethereum Cryptocurrency: Understanding, Investing, and Future Outlook

Introduction to Ethereum Cryptocurrency

In the world of digital currencies, Ethereum stands as a prominent figure, often regarded as the second most popular cryptocurrency after Bitcoin. But what exactly is Ethereum, and why has it gained such widespread attention? Let’s dive into the world of Ethereum and explore what makes it a unique and powerful player in the blockchain ecosystem.

What is Ethereum?

Ethereum is an open-source, decentralized blockchain platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Unlike Bitcoin, which primarily functions as a digital currency, Ethereum offers a comprehensive platform for creating digital assets and executing agreements automatically without the need for intermediaries.

The Birth of Ethereum

Ethereum was proposed by Vitalik Buterin in late 2013 and launched in 2015. It aimed to address the limitations of Bitcoin by providing more functionality for decentralized applications. Ethereum quickly became the foundation for a wide range of blockchain-based projects and innovations, revolutionizing the cryptocurrency and tech industries.

How Ethereum Works

To understand Ethereum, it’s important to know how the platform operates and what sets it apart from other cryptocurrencies.

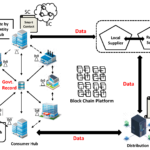

Blockchain Technology and Smart Contracts

Ethereum is built on blockchain technology, which is a distributed ledger that records all transactions across a network of computers. What sets Ethereum apart is its ability to execute smart contracts—self-executing contracts where the terms of the agreement are directly written into lines of code.

These contracts automatically carry out tasks when certain conditions are met, eliminating the need for manual intervention.

Ethereum vs Bitcoin: Key Differences

While both Ethereum and Bitcoin are cryptocurrencies, their purposes differ. Bitcoin is designed as a digital currency, while Ethereum’s blockchain allows for more versatility through smart contracts and decentralized applications (dApps). In simple terms, Bitcoin is like digital gold, and Ethereum is a platform for building decentralized systems.

Understanding Ether (ETH)

Ether (ETH) is the native cryptocurrency of the Ethereum network. But what role does ETH play in this complex ecosystem?

What is Ether?

Ether is used to power applications and transactions on the Ethereum network. It’s not just a store of value like Bitcoin but also functions as “fuel” for executing smart contracts and interacting with decentralized applications (dApps).

The Role of Ether in the Ethereum Network

Ether is integral to the Ethereum ecosystem because it incentivizes miners (or validators in the case of Ethereum 2.0) to maintain the network’s security and ensure the smooth execution of smart contracts. Users must pay gas fees in Ether to use the Ethereum network, thus making it a vital resource for Ethereum’s operations.

The Ethereum Blockchain Explained

The Ethereum blockchain is the backbone of all transactions and applications within the Ethereum network.

How Ethereum Blockchain Operates

Like other blockchains, the Ethereum blockchain is composed of a series of blocks containing transaction data. Each block is linked to the previous one, creating an immutable and secure record of transactions. Ethereum’s blockchain, however, is unique because it also stores the code for smart contracts, making it a platform for more than just digital transactions.

The Importance of Decentralization

One of the key features of Ethereum is decentralization. Instead of relying on a central authority, Ethereum’s network is maintained by a distributed group of nodes (computers). This ensures that no single entity controls the network, providing transparency and security.

Ethereum Mining vs. Staking

Ethereum’s consensus mechanism has evolved, and understanding the differences between mining and staking is crucial for anyone interested in participating in the network.

Proof of Work (PoW) and Proof of Stake (PoS)

Ethereum initially used Proof of Work (PoW) for mining, similar to Bitcoin. However, Ethereum is transitioning to Proof of Stake (PoS) with Ethereum 2.0, where validators stake Ether to secure the network instead of performing energy-intensive computations.

Benefits of Ethereum 2.0

Ethereum 2.0, also known as Serenity, promises significant improvements, such as greater scalability, reduced energy consumption, and more efficient transaction processing. With the transition to PoS, Ethereum aims to enhance network security and make the ecosystem more sustainable.

Smart Contracts: Revolutionizing the Digital World

Ethereum’s innovative smart contracts have had a profound impact on industries worldwide.

What Are Smart Contracts?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts are automated, and once deployed, they cannot be changed, ensuring security and trust among parties involved in a transaction.

How Smart Contracts Work in Ethereum

On Ethereum, smart contracts are deployed on the blockchain, where they automatically execute when specific conditions are met. For example, in a real estate transaction, a smart contract could transfer ownership once the buyer’s payment is confirmed.

Ethereum’s Role in Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is one of the most groundbreaking applications of Ethereum’s blockchain.

Introduction to DeFi

DeFi refers to a movement that aims to create an open, permissionless, and decentralized financial system. Instead of relying on traditional banks and financial intermediaries, DeFi platforms use smart contracts and blockchain technology to provide financial services like lending, borrowing, and trading.

Ethereum’s Impact on the DeFi Ecosystem

Ethereum’s smart contract capabilities have made it the foundation for most DeFi applications. Platforms such as Uniswap, MakerDAO, and Aave are all built on the Ethereum blockchain, offering decentralized alternatives to traditional financial services.

The Rise of Non-Fungible Tokens (NFTs)

Another major trend that has taken the digital world by storm is the rise of Non-Fungible Tokens (NFTs).

What Are NFTs?

NFTs are unique digital assets that represent ownership of a specific item, be it artwork, music, or even virtual real estate. Unlike cryptocurrencies like Bitcoin or Ether, NFTs are indivisible and unique, making them a popular choice for collectors and artists.

NFTs on Ethereum

Ethereum’s blockchain is the most widely used platform for minting and trading NFTs. The majority of NFTs are built using the ERC-721 standard, which is specifically designed for creating non-fungible tokens.

Ethereum’s Role in Tokenization

Tokenization refers to the process of converting real-world assets into digital tokens that can be traded on blockchain networks.

Tokenization of Assets

Ethereum allows for the creation of various types of tokens, including security tokens, utility tokens, and asset-backed tokens. This ability to tokenize assets opens up new opportunities for fractional ownership and global trading.

Use Cases of Ethereum Tokens

Examples of tokenized assets on Ethereum include real estate, art, and even shares in companies. Tokenization on Ethereum is transforming industries by making it easier to transfer and invest in assets digitally.

Ethereum 2.0: A New Era

The long-awaited Ethereum 2.0 upgrade promises to enhance the platform’s scalability, security, and sustainability.

What is Ethereum 2.0?

Ethereum 2.0, or Eth2, is a major upgrade to the Ethereum network designed to improve its performance. It involves switching from Proof of Work (PoW) to Proof of Stake (PoS) and introducing a series of technical improvements.

Key Improvements and Features

Ethereum 2.0 is expected to drastically increase transaction speeds, reduce costs, and make the network more environmentally friendly. These changes are vital for Ethereum to maintain its position as a leading blockchain platform in the rapidly evolving crypto space.

How to Buy Ethereum

If you’re looking to invest in Ethereum, here’s how you can get started.

Choosing a Platform to Buy Ethereum

To buy Ethereum, you’ll need to sign up for a cryptocurrency exchange like Coinbase, Binance, or Kraken. These platforms allow you to trade fiat currency (like USD) for Ether (ETH).

Storing Your Ethereum Safely

Once you’ve purchased Ethereum, it’s essential to store it safely. You can keep your Ether in an exchange wallet, but for greater security, consider using a hardware wallet such as Ledger or Trezor.

Risks of Investing in Ethereum

Like any investment, Ethereum comes with risks. Let’s explore some of the most significant concerns.

Volatility and Market Risks

Ethereum, like most cryptocurrencies, is highly volatile. Prices can fluctuate dramatically, and investors should be prepared for the possibility of losses.

Security and Regulatory Concerns

While Ethereum’s blockchain is secure, the broader crypto market faces regulatory uncertainty. Governments around the world are grappling with how to regulate cryptocurrencies, which can affect Ethereum’s future.

Ethereum’s Environmental Impact

Ethereum’s energy consumption has been a topic of debate, especially due to its Proof of Work mining mechanism.

Energy Consumption of Ethereum Mining

The Proof of Work consensus mechanism used by Ethereum requires miners to solve complex mathematical problems, consuming significant amounts of energy.

Transition to Proof of Stake

With Ethereum 2.0, the platform is transitioning to Proof of Stake, which is much more energy-efficient, addressing concerns about its environmental impact.

Ethereum’s Future: What’s Next?

As Ethereum continues to evolve, its future looks bright, with several improvements on the horizon.

Potential for Scalability and Speed

With the introduction of Ethereum 2.0, scalability will become one of its standout features, allowing for faster transaction processing and reduced network congestion.

Upcoming Ethereum Updates

The Ethereum network is continually being upgraded, and future enhancements will focus on further improving security, scalability, and functionality.

Conclusion

Ethereum has revolutionized the blockchain landscape with its ability to support decentralized applications, smart contracts, and digital assets like NFTs. As it continues to evolve through Ethereum 2.0 and beyond, its influence on industries such as finance, art, and gaming will only grow.

FAQs

What makes Ethereum different from Bitcoin?

Ethereum is not just a cryptocurrency; it’s a platform that enables the creation of decentralized applications and smart contracts, while Bitcoin primarily serves as a digital currency.

How do I invest in Ethereum?

You can invest in Ethereum by purchasing it on a cryptocurrency exchange and storing it in a secure wallet.

What is the current price of Ethereum?

The price of Ethereum fluctuates constantly due to market conditions. Check real-time prices on crypto exchanges.

What are Ethereum’s advantages for developers?

Ethereum provides developers with the ability to create smart contracts and decentralized applications, offering flexibility and control over decentralized systems.

How secure is Ethereum compared to other cryptocurrencies?

Ethereum is considered one of the most secure cryptocurrencies due to its decentralized network and robust cryptographic measures. However, like all cryptocurrencies, it’s not entirely risk-free.